As ethereum to bitcoin takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In the rapidly evolving landscape of cryptocurrencies, Ethereum and Bitcoin stand out as two of the most significant players. While both have revolutionized the financial industry, their foundational principles, technologies, and market applications set them apart. Understanding their unique characteristics, market performance, and future trends is essential for anyone looking to navigate the digital currency space effectively.

Overview of Ethereum and Bitcoin

Ethereum and Bitcoin are two of the most well-known cryptocurrencies, each built on unique principles and technologies. Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, was designed as a decentralized digital currency enabling peer-to-peer transactions without the need for intermediaries. Ethereum, launched in 2015 by Vitalik Buterin and others, extends the concept of blockchain technology by introducing smart contracts, allowing developers to create decentralized applications (dApps) on its platform.The technology behind Bitcoin is relatively straightforward, utilizing a proof-of-work consensus mechanism to secure transactions and maintain the integrity of the blockchain.

In contrast, Ethereum started with a similar model but has since transitioned towards a proof-of-stake mechanism with Ethereum 2.0, aiming to improve scalability and sustainability. While Bitcoin primarily serves as a digital gold and store of value, Ethereum is recognized for its versatility, powering a wide range of applications across sectors such as finance, gaming, and supply chain management.

Market Performance

When examining the historical market trends of Ethereum and Bitcoin, Bitcoin has consistently maintained its position as the leading cryptocurrency in terms of market capitalization. Over the last five years, both cryptocurrencies have experienced significant price fluctuations, driven by a variety of factors including market sentiment, regulatory news, and technological advancements.Data from the last five years highlights the extreme volatility present in the cryptocurrency market.

Bitcoin’s price surged from around $6,800 in October 2018 to a peak of approximately $64,000 in April 2021, followed by drastic corrections. Ethereum displayed similar volatility, rising from about $200 in October 2018 to over $4,300 during the same period. Factors influencing these trends include macroeconomic indicators, institutional adoption, and competitive pressures from emerging cryptocurrencies.

Technical Differences

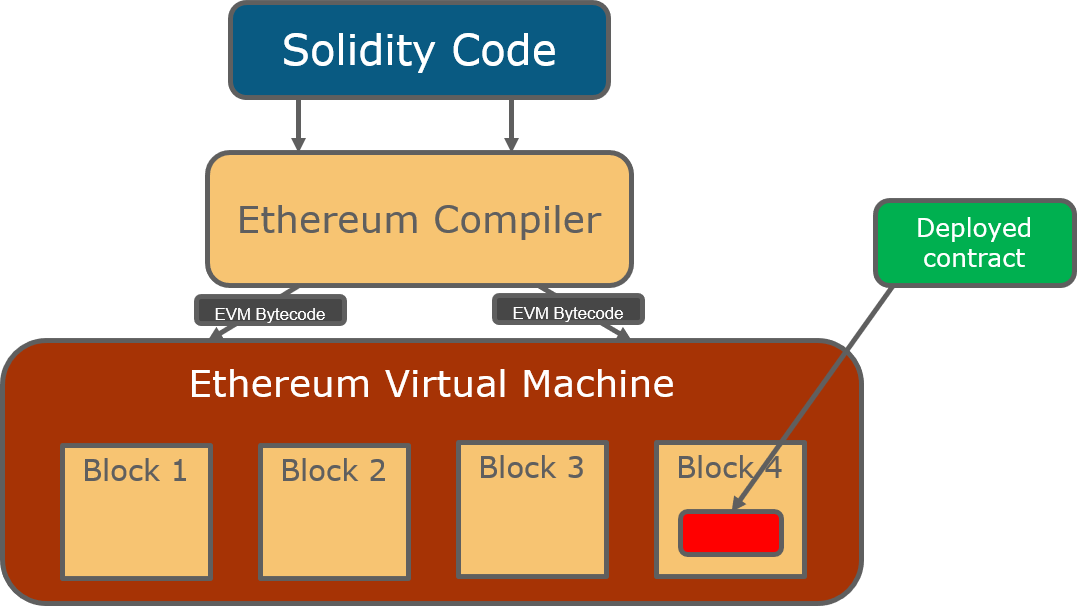

A critical aspect of the Ethereum and Bitcoin comparison lies in their consensus mechanisms. Bitcoin employs a proof-of-work system, which requires miners to solve complex mathematical problems to validate transactions, while Ethereum is transitioning to a proof-of-stake model that allows validators to create new blocks based on the number of coins they hold and are willing to “stake” as collateral.Ethereum’s smart contract capabilities stand in stark contrast to Bitcoin’s limited scripting language.

Smart contracts are self-executing contracts with the terms of the agreement directly written into code, enabling developers to create sophisticated decentralized applications. In comparison, Bitcoin’s functionality is limited primarily to value transfer.Scalability solutions are also a significant focus for both networks. Bitcoin is exploring technologies like the Lightning Network to facilitate faster transactions, while Ethereum is implementing sharding and layer-2 solutions to enhance its throughput and reduce congestion on the main chain.

Investment Considerations

Investing in Ethereum versus Bitcoin involves different risk factors. Bitcoin is often viewed as a safer asset due to its established history and broad adoption as a store of value. In contrast, Ethereum, while promising due to its innovative technology and applications, carries higher volatility and risk associated with its evolving ecosystem.Potential returns on investment for both cryptocurrencies can be substantial, but they are accompanied by varying levels of risk.

Bitcoin has shown a historical tendency for significant price increases, while Ethereum’s growth is tied to the success of its dApps and network upgrades.Liquidity and trading volumes present another key difference in the market. Bitcoin generally exhibits higher liquidity, making it easier for investors to enter and exit positions. Ethereum, while also liquid, shows increased trading activity during times of high interest in DeFi projects and NFT marketplaces.

Community and Development

The communities supporting Ethereum and Bitcoin are vibrant and diverse, reflecting the values and goals of their respective projects. Bitcoin’s community has a strong emphasis on security and decentralization, often prioritizing the integrity of the network over rapid development. In contrast, the Ethereum community is known for its innovation and collaborative approach, frequently engaging in discussions about new features and improvements.Ongoing development initiatives differ significantly between the two.

Bitcoin focuses on enhancing security and scalability, with proposals like Taproot aimed at improving privacy and transaction efficiency. Ethereum, meanwhile, is undergoing a substantial transformation with the Ethereum 2.0 upgrade, which seeks to address scalability and energy consumption issues.Forks have played a critical role in the evolution of both cryptocurrencies. Bitcoin has experienced notable forks like Bitcoin Cash, which arose from debates over block size and transaction fees.

Ethereum has also seen forks such as Ethereum Classic, stemming from the contentious hard fork following the DAO hack in 2016.

Regulatory Environment

Both Ethereum and Bitcoin face significant regulatory challenges globally. Governments are increasingly scrutinizing cryptocurrencies, leading to potential regulatory frameworks that could impact their development and adoption. Bitcoin tends to attract attention due to its role in facilitating anonymous transactions, while Ethereum’s smart contract capabilities raise concerns about consumer protection and security.Regulations may shape the future landscape of both cryptocurrencies. For instance, potential tax regulations could influence investor behavior, while compliance requirements for exchanges might alter trading dynamics.

The response of Ethereum and Bitcoin to regulatory scrutiny has been proactive, with both communities pushing for clearer regulations that foster innovation while protecting users.

Future Trends

Looking ahead, the future of Ethereum and Bitcoin in the next decade appears promising, albeit with challenges. Both cryptocurrencies are likely to see increased adoption as mainstream financial institutions and businesses recognize their potential. Emerging technologies, such as artificial intelligence and the Internet of Things (IoT), may enhance the functionality and use cases for both cryptocurrencies, fostering further integration into daily life.Potential scenarios for adoption include greater use of Bitcoin for remittances and as a hedge against inflation, while Ethereum may become a foundational layer for decentralized finance (DeFi) and non-fungible tokens (NFTs), leading to transformative effects on traditional industries.

The interplay between regulatory developments and technological advancements will ultimately shape the trajectory of both Ethereum and Bitcoin in the evolving digital economy.

Conclusive Thoughts

In conclusion, the discussion surrounding ethereum to bitcoin unveils not just the differences between these two cryptocurrencies but also their potential futures in a digital economy. As they continue to develop and adapt to market demands and regulatory pressures, both Ethereum and Bitcoin are likely to play pivotal roles in shaping the future of finance.

Commonly Asked Questions

What are the main differences between Ethereum and Bitcoin?

Ethereum focuses on smart contracts and decentralized applications, while Bitcoin primarily serves as a digital currency and store of value.

Which is a better investment, Ethereum or Bitcoin?

It depends on individual risk tolerance and investment goals; both have their advantages and potential for growth.

How do transaction speeds compare between Ethereum and Bitcoin?

Ethereum generally has faster transaction speeds, processing blocks approximately every 15 seconds compared to Bitcoin’s 10 minutes.

Are Ethereum and Bitcoin affected by the same market trends?

While both can be influenced by overall market conditions, they often react differently due to their distinct use cases and technological frameworks.

What role do forks play in Ethereum and Bitcoin?

Forks can lead to changes in protocol or create new cryptocurrencies, affecting community dynamics and market perceptions for both Ethereum and Bitcoin.